Table of Contents of this Post

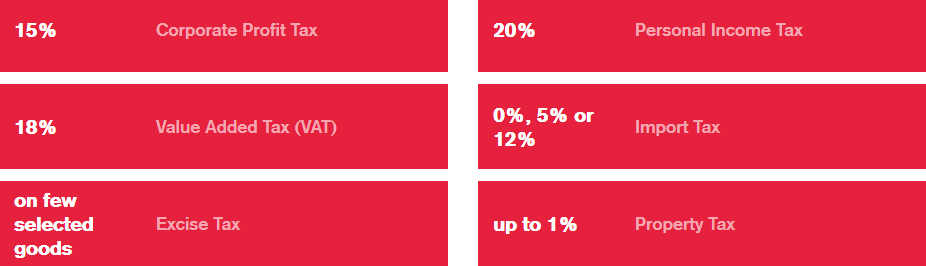

List of Taxes in Republic of Georgia | Easy made Taxation in Georgia

initially, There are only six taxes for limited liability companies in Georgia. I have seen many people opening LLC in Georgia without understanding prospective taxation for this type of legal entity. Hereby, I would highly suggest before open LLC and Start a business in Georgia make sure you understand the differences in the forms of legal entities since these differences directly affect your pocket and in the end wealth. Here I made a case study and tried to list differences between Individual Entrepreneur and LLC since these are two most wide-spread legal form for entrepreneurial activities and highly different in terms of taxation obligations. Finally, If you decide to start LLC business, which is somehow also called LTD in Georgia check below the taxes imposed:

# List of Taxes and Tax Rates in Georgia

* First, Personal income tax – tax rate 20%

* Second, Corporate income tax – rate 15%

* Third, Value added tax -rate 18%

* Next, Excise tax – depends

* Then, Import tax – depends 0%, 5%, 12%

* After that, Property Tax ( Local Tax) – tax rate up to 1%

as you have successfully counted there are six types of taxes. You do not need paying all taxes straight away. Most importantly, Tax Obligation arises when taxbase took place. Most of companies our accountants work with pay only the first two types of taxes. So in short whenever you establish a company in Georgia only requirement is to have proper accounting in place to meet taxation obligations set by tax code of Georgia. In case you don’t have activities, no obligations. As soon as you start activities you need making sure that you declare to Tax Authority, which is called revenue house of Georgia.

Watch my Video on Taxation System in Georgia too

Special Taxation Systems | Taxation in Georgia

Initially, In Georgia there are some special systems defined by law which does not comply with above mentioned taxation structure. In accordance, within these regimes there are different taxation implications allowed.

* first, Corporate income tax ——————————————Exempt

* second, Value added tax ——————- Exempt

first, Corporate income tax (allowable activities) exempt

Second, Value added tax (supply within free industrial zone) exempt

then, Import tax (goods produced in free industrial zone) exempt

after that, Property tax (including on land) exempt

A comprehensive overview about Free Industrial Zones be found here.

first, Corporate income tax (allowable activities other than supply of fixed assets used in economic activities for more than 2 years) ——————————————-Exempt

Second, Value added tax (supply of foreign goods in a customs warehouse) ———-Exempt

next, Import tax ———————————————————————————– Exempt

First of all, Georgia has two unique Free Tourism Zones Anaklia and Kobuleti. Then, Exemptions from Property and Profit Taxes – hotel activities are exempted from Profit and Property taxes until 2026. Notably, a person organizing totalizator in the system-electronic form will be taxed at a fixed 5% rate on its total income

Special Taxation Regimes

Notably, We have previously talked about differences between Individual Entrepreneur and Limited Liability Company and which business to start in Georgia. Well, main characteristic and benefit, I would say, of Individual Entrepreneurship business is special taxation regimes which you can only claim under this type of entity.

• First, Conducts certain economic activities independently without hiring

employees

• Second, Receives annual income not exceeding GEL30,000

• Third, Maintains inventory balance not exceeding GEL45,000

• Last,Undertakes activities that are not banned for micro business as

defined by Government of Georgia

Tax benefits and compliance

* The first, Exempted from personal income taxation.

* The Second, Exempted from obligation to withhold tax at source upon payment of service fees. Microbusinesses must keep primary tax

documentation.

• First, Receives annual income from certain business activities not exceeding GEL100,000

• Second, Maintains inventory balance not exceeding GEL150,000

Tax benefits and compliance

* Firstly, Personal income tax at a 5% rate. applicable personal income tax rate further reduces to 3% if the Small Business has documentary proof of expenses related to receipt of income in amount of 60% of total income.

* Second of all, A small business is not obliged to withhold tax at sources upon payment

of:

• one, Salaries within 25% of total income for calendar year

• another, Service fees

to conclude, A small business should keep all primary tax documentation. However, it may keep records of expenses in simplified register according to rules defined by relevant authority

*First, Flat rate income tax payers exempted from cash-registers

* Second, While taxpayer is subject to flat rate income tax, he is not liable to report to tax authority neither income tax nor corporate income tax returns. Simultaneously, taxpayer is charge-exempted

English Speaking Accountants in Georgia

Are you looking for a decent service, with English-speaking staff? You do not want to pay dozens for that reason? You are one step apart from getting the reasonable accounting deal in Georgia. We can help you with full package accounting or just be your taxation officer. Either way, if you are looking for a decent English Speaking Accountant in Georgia or a taxation officer only, first read our offer here, if it looks good for you, fill this simple form. We will follow up with you as soon as possible.

Tax Bases for Taxes Imposed on Georgian Company | Taxation Made Simple in Georgia

As mentioned before, often times, people freak out hearing different tax rates, thinking that It is needed to pay all these taxes on a daily basis. Actually not, we need to understand what is tax base and when does tax liability for all these different taxes arise in Republic of Georgia.

Personal income tax | Taxes in Georgia

Initially, For Georgian personal income tax purposes, total income comprises any

income received in any form and from any activity that is divided into

the following categories:

• First, Income from employment

• Second, Income from economic activities

• Third, Other income not related to employment and economic activities.

Corporate income tax | Types of taxes in Georgia

The tax rate is a flat 15%. Moreover, Income subject to corporate income tax (i.e., tax base) is currently computed based on IFRS and modified by certain tax adjustments. Especially, foreign companies are subject to tax on Georgian source income only, subject to double taxation treaty relief. Most importantly, A foreign company, carrying out business activities through a permanent establishment in Georgia, generally has to assume the same tax obligation as a Georgian company generating Georgian source income only. Hereby, Corporate income tax returns can be filed either personally, electronically (see section “E-services”, p. 78), or sent via insured mail within three months of the end of the tax period.

Value added tax (VAT) in Georgia

In the beginning, The VAT rate is 18% for all taxable transactions and imports, unless a specific provision allows an exemption.

VAT taxable transactions

include:

• first, Supply of goods or services within the scope of economic activities that is considered as carried out in the territory of Georgia (including barter and gratuitous supplies)

• second, Use of VAT taxable goods and services for non-economic purposes, if

the taxpayer has obtained a VAT credit for these goods and services

• third, Upon cancellation of VAT registration, the balance of goods for which the taxpayer has obtained a VAT credit

• four, Use of self-constructed buildings as fixed assets

• next, Transfer of ownership on goods/services in exchange for a share in a legal entity or partnership

• sixth, Upon expiry or early termination of a rental agreement, supply of leasehold improvement to the lessor

• seventh, Upon expiry or early termination of the status of tourist enterprise, the difference between the compensation for the supply of the hotel’s assets or parts thereof and the declared VAT taxable amount in the result of hotel operations

• eighth, Supply of goods or services by a taxpayer to its employees with or without compensation

• then, Export or re-export of goods outside Georgia

• last, Import or temporary import of goods into Georgia.

As previously noted, supplying goods or services is subject to VAT taxation if it is considered to be carried out in the territory of Georgia. Thus, it is crucial for VAT taxation to define the place of supply of goods and services.

# Notes to Take into Account

* Place of supply is wherever the goods are actually supplied or where transportation of goods starts, if the supply of goods requires transportation.

• next, Place of supply of electrical or thermal energy, gas and water is the place of receipt of these goods Place of supply for services Depending on the nature of a service, the place of supply is: The location of immovable property if the service is related to this property

• then, The place of actual supply if the service is related to movable property or is rendered in the sphere of culture, art, education, tourism, recreation, gymnastics or sport; the location of passengers or cargo upon start of their transportation, if the service is related to this transportation

• The place of registration or management of a service recipient or location of its permanent establishment (if the service is related to the latter), if the service provider and the service recipient are located in different countries; this provision applicable for the supply of intangible assets; consultation, legal, accounting, engineering and similar services; staff provisioning services; advertising services; financial, insurance and re-insurance operations; renting movable property except means of transportation; telecommunication, radio 3. Companies 81 and television services; services provided electronically ; If a particular service qualifies for more than one of the above cases, the place of its supply is defined based on the first case. For example, if consulting services are provided with respect to immovable property located in Georgia, then such a service would qualify for the first, as well as the forth, case. However, as the first case prevails, Georgia may be considered as a place of supply.

Taxpayers are liable to register as a VAT payer if they:

• First, Carry out economic activity and the aggregate value of their VAT taxable transactions exceeds GEL100,000 in any continuous period of 12 calendar months; a taxpayer must file an application for VAT registration to the GTA within 2 working days of exceeding the

82 Pocket Tax Book. Georgia threshold. Notably, a person supplying only in the territory of a

special trade zone does not have an obligation to register as a VAT payer.

• Second, Produce or import excisable goods into Georgia (except excisable goods exempt from VAT taxation upon import); a taxpayer must file an application for VAT registration to the GTA before supplying excisable goods in Georgia.

• Next, Represent entities established as a result of a reorganization and at least one of the parties to the reorganization is a VAT payer; a taxpayer must file an application for VAT registration to the GTA before a VAT taxable transaction is carried out, but no later than 10

calendar days from the completion of the reorganization.

• then, Represent legal entities or partnerships and a VAT payer shareholder or partner contributed goods or services into their capital; a taxpayer must file an application for VAT registration to the GTA before a VAT taxable transaction is carried out, but no later than 10 calendar days

from such a contribution

Transactions exempt with the entitlement to credit - VAT TAX Free Status |Taxation in Georgia

• Firstly, Export or re-export of goods

• Secondly,Supply of goods or services intended for the official use of foreign diplomatic and equal representative offices

• Then,Transportation of passengers and luggage and supply of related services, provided that either the departure or destination point is Located outside Georgia

• Next,Transportation of goods placed in export, re-export, external processing or transit operations, and supply of related services

• after that, Transportation of goods not yet placed in import, warehouse, temporary import, internal processing or free zone operations between the two points located in Georgia, and supply

• last,Transportation of goods placed in import, warehouse, temporary import, internal processing or free zone operations before entering into the territory of Georgia, from the customs border of Georgia to the destination point

• Supply of services related to transportation, loading, unloading and storage of empty transportation means used in transportation

# Things that need Special Attention | Taxation in Georgia

• First,Import or supply of goods to be provided on international flights and international sea passages

• Second, Supply of Georgian goods for sale in a duty free zone

• Third, Supply of goods or food services in a duty free zone

• Next, Supply of assets under reorganization

• After that, Contribution of assets into the capital of a legal entity/partnership, where the latter has theoretically credited VAT on these assets upon the contribution

• Then, Supply of gold to the NBG

• after that, Organized foreign tours into Georgia by tour operators and the supply of tourist packages by the latter

• then, Supply of business as a going concern by one VAT payer to another, provided that both parties notify the GTA within 15 calendar days from such supply

• after that, Supply of foreign goods in a customs warehouse, (In case of future importation of goods, please refer to section “Reverse charge VAT”, p. 94) initial supply of agricultural products (except eggs) produced in Georgia before their processing (i.e., change of code), other than

supply by persons engaged in agricultural activities

• finally, Supply of beef, pork, sheep and goat meat, as well as industrially processed cheese produced from local materials, other than supply by persons engaged in agricultural activities

Transactions exempt without the entitlement to credit

• first, conduct of financial operations and/or supply of financial services

• second, import and/or supply of goods and services under the Law of Georgia on Oil and Gas

• third, Import or temporary import of goods intended for the personal use of citizens of foreign countries employed at oil and gas exploration and extraction works

• fourth, Import or supply of certain medicines, passenger cars, yachts, publications and mass media, and baby products

• fifth, Supply of educational and medical services

• next, Supply of land plots

• then, Supply of betting and gaming services (except by a person with more than 50% state ownership)

• after that, Import of goods by an issuer or a recipient of a grant as defined by the grant agreement

• then, Transfer of assets under leasing, where these assets are exempt from VAT without the entitlement to credit

• after that, Import of most food products by an individual (including via mail) not

intended for economic activity with a value up to GEL500 and weighing up to 30 kg during a calendar day, as well as non-food productsduring 30 calendar days (except import from a free industrial zone), import of 400 cigarettes or 50 cigars or 50 cigarillos (slim cigars) or

250 grams of other tobacco products (except tobacco raw materials) or combination of all mentioned products up to 250 grams via mail, or during a calendar day by air transport and during 30 days by other means of transportation in case of import by an individual,

also import of 4 liters of alcoholic beverages (except import of goods from a free industrial zone)

# Also important things to pay attention | Taxation in Georgia

• first, Import of non-food products not intended for economic activity with the value up to GEL300 via mail (or GEL3,000 in case of import by an individual) and weighing up to 30 kg

• Second, Import of non-food products by air transport by an individual staying outside Georgia for more than six months not intended for economic activity with a value up to GEL15,000

• Third, Supply of goods or services between free industrial zone companies

• next, Supply of shares in partnership, except receiving the property in individual ownership in exchange for the shares

• then, Supply of property by the partnership to its members, provided that the members are individuals only

• finally, Temporary import of fully exempt goods from VAT taxation

Frequently asked questions about taxation in Georgia

What paperwork do I need to prepare in order to pay Georgian workers (local tax forms, etc.)

First of all, you need to have a legal entity/company to be able to pay taxes for your workers. Then, you need to set up your revenue Portal. Importantly, the revenue Portal is all in Georgia. Moreover, Income tax is a withholding tax so as you need to declare your taxes right after paying out them. Surely, This is done by sending accounting declarations. Apart from sending declarations, you should have internal bookkeeping in place. Also, I bet, it is hard to manage and is overwhelming for a person who does not speak Georgian or does not have theoretical knowledge in taxation and accounting at least. I mean, if you have time, you can dig into and study anything in this world. If you need to save 150-350 gel probably after a while you will figure it out. But my personal experience is that even though there are some people always working in taxation and accounting field they make sometimes a problem. And, My advice is, initially, you should look for a professional accountant who will take care of all this on behalf of you and concentrate on your operating activities. To conclude, It does not necessarily have to be us, but if you consider us here is the offer. That’s it.. 🙂

Do I need to pay tax in Georgia when I rent a property?

Once you rent an office, shop, or any real estate property as the company the second party (tenant) can be an individual person or the company. in case the agreement is made between two companies, the tax obligation is levied on the one who receives the income. On the contrary, in the deal made between the company and individual person, the company is liable to impose and treat accordingly the income tax levied on the individual person. iN other words, the company needs to pay the tax which is imposed on the individual person. Income tax in Georgia is 20% and is withholding by nature. Withholding tax needs to paid together with the payment when payment is made.

How can I pay tax in Georgia?

It’s pretty simple. If you have a company bank account, usually all of them have the function of transferring to the treasury. You can easily transfer tax to the treasury using internet banking. Do not forget that this transfer needs to be properly allocated. In order to allocate tax correctly ) is it dividend tax, profit tax, income tax?) you need to submit accounting declarations monthly basis. Apart from that, all should be reflected in your internal bookkeeping as well. If you need any help to set up your taxation and accounting correctly, feel free to contact us, we can help you with that.