Table of Contents of this Post

ToggleIf you are considering Georgia to start your business in, then you are searching for a Tax Haven, I assume. In this article, we will summarize Legal forms in Georgia and concentrate on one of them – Individual Entrepreneurship. We have much to announce to you – what you are expected to benefit from, what requirements you should meet to be able to register individual entrepreneurship, so-called sole-proprietorship, and so much more. we will present a clear comparison gap to differentiate Micro Business status and Small Business status. Maybe also you wonder how you can obtain them, so let’s get started, stay tuned to dive in. So, how can you register individual entrepreneurship business in Georgia, Europe?

Individual Entrepreneurship Company registration service offer in Georgia, Country

- Permanent Legal address if needed

- Our remote consultation, assistance and guidance

- Physically being present with you

- Registration with local tax authorities in the tax payer portal

- application for small business status.

We do provide full scale busieness startup support. Business registration is an initial step, followed by full scale support. Your success is our goal.

Information for Remote Business Registration

- Drafting the POA

- POA translation and legalization in Georgia

Step-by-Step Registering a company remotely

1. We do prepare POA and send to you

2. You need to apostille or Legalize this POA and your passport copy in your country.

3. Send Original Version by Post.

4. We translate and legalize the docs in Georgia.

5. We Register the company remotely.

Opening Bank Account remotely for Individual Entrepreneurship Business

Legal forms for Business Registration in Georgia

Under the law, Georgia has 6 Legal-organizational forms to offer natives, as well as, foreign individuals. They are:

- Individual Entrepreneurship

- General Partnership

- Limited Partnership

- Limited Liability Company

- Joint Stock Company

- Cooperative

let’s discuss each legal form one by one briefly:

1. Individual Entrepreneurship

Let us start with the fact that individual entrepreneurship is a legal form of organization of entrepreneurial activity by one person, in other words, an independent natural person. It should be noted that an individual enterprise is not a legal entity. Accordingly, the entrepreneur comes out in his own name as an individual. We will further discuss details on Individual entrepreneurship registration in Georgia in this blog, below.

2. General Partnership

is a company where several people (partners) conduct entrepreneurial activities jointly, with the same company name, and are jointly and severally liable with all their assets to the creditors as joint debtors.

3. Limited Partnership

is a variant of the general partnership. Unlike a general partnership, a limited partnership has two types of partners:

- Complementary, in other words, a personally responsible partner. It should be noted that his responsibility to the entity is unlimited. Accordingly, he bears the liability with all his property.

- A limited partner whose liability to the entity is limited to the amount of the guarantee lodged by him

4. Limited Liability Company (LLC also referred as LTD)

The emergence of a limited liability company was caused by two circumstances. First of all, it was to change the complicated procedure of establishing a joint-stock company to a more liberal one. The second was the issue of responsibility. Although there were forms of associations of individuals such as general partnerships or limited partnerships, many refused to participate because they did not want to be liable to the creditors with all their personal property. This is what led to the establishment of an LLC in Commercial Law.

5.A joint-stock company

whose initial capital is divided into shares with the same nominal value. It should also be noted that in Western countries, joint-stock companies are usually large industrial and commercial companies. Unlike limited liability, it is not an artificial creation of legislation, but rather the result of the long development of economic life.

6. Cooperative

The main motive of origin was self-help or a form of organization of members, the main purpose of which was to meet the needs of individuals united in them.

Individual Entrepreneurship - what is it?

Let’s start with the fact that an individual entrepreneur is not a legal entity. At the same time, the individual entrepreneur executes his rights and duties in business relations as a natural person.

In addition, the individual entrepreneur in business relations comes out on his own behalf. An individual entrepreneur is liable to creditors personally, with all his property, for the obligations arising from his entrepreneurial activity.

It is also noteworthy that an individual entrepreneur arises only from the moment of registration in the register of entrepreneurs and non-entrepreneurial (non-commercial) legal entities.

If any action was taken on behalf of the entrepreneur before registration, the executors of this action and the founders of the enterprise shall be liable personally as joint and several debtors, with all their property, directly for all obligations arising from this action.

This responsibility remains valid even after the registration of the entrepreneur. In case of cancellation of the registration of an individual entrepreneur, his / her legal successor is the relevant natural person.

How to establish IE in Georgia?

Georgian law sets out the procedure for the registration of an individual entrepreneur differently.

To continue with the fact that an individual entrepreneur or a person authorized to represent the enterprise for the state and tax registration of an individual enterprise sends an insured letter to the tax authority authorized for registration according to his place of business or submits an application in 2 copies. To fill in the application, a person has the right to use the application form or a copy of it issued by the tax authority. Any person has the right to obtain an application form in the tax authority without hindrance, as well as to copy it freely and without permission.

Requirement for registering Individual Entrepreneurship in Georgia

- brand name

- Name, surname, citizenship, place of residence, number of the identity document (certificate, passport), personal number of the individual entrepreneur

- location of individual enterprise. The legal address. (place of activity)

- the signature of the individual entrepreneur.

Alongside this:

- It is not allowed to request another document or information.

- Both copies of the application must be notarized.

tax authority authorized for registration is obliged to register the individual enterprise in state and tax registration within 1 working day after submitting the application. If the applicant is not notified in writing of the motivated refusal within this period, the individual enterprise will be considered registered. The tax authority is obliged to assign an identification number to the registered individual enterprise and immediately issue the relevant state and tax registration certificate.

Documents to be submitted for IE company Registration in Georgia Country

- Application (the above is filled indirectly in the relevant electronic program by the operator receiving the documents);

- Copy of the identity document of the interested person (ID card, passport, residence card, neutral ID card, or neutral travel document);

- proof of the legal address

- Proof of payment of service fee

How long does it take to register a company in Tbilisi?

Accelerated service is also possible. Company Registration normally takes just 2 days. In this case, the service fee and term are as follows:

The deadline starts on the day following the submission of the application and ends with the expiration of the last day of the deadline. If the last day of the term coincides with a holiday or weekend, the last day of the deadline is the next working day.

In case of expedited service (on the day of submitting the application) the calculation of the term starts as soon as the application is registered and ends with the expiration of this day.

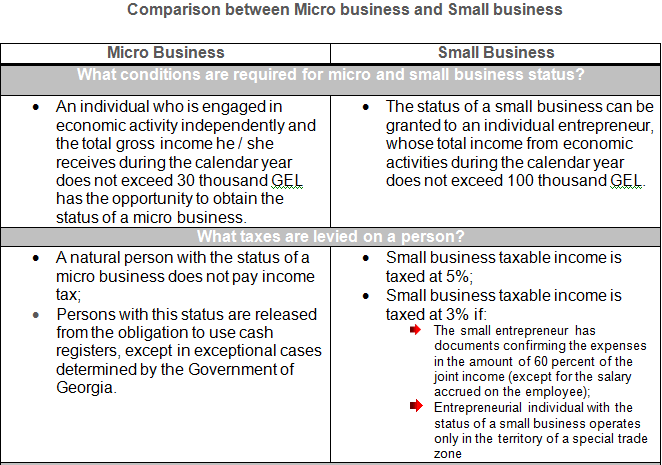

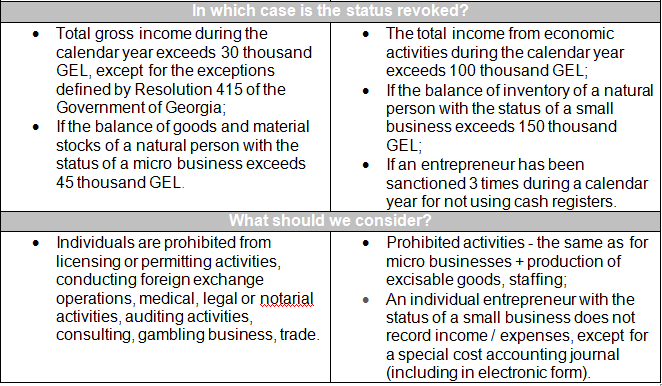

Small and Micro Business status

With individual entrepreneurship, you are eligible to claim the special statuses for tax reduction. These are micro and small business status. Let’s start with the fact that the new tax code applies special – preferential tax regimes to individuals with micro and small business status. From here, micro-businesses are not taxed with income tax, while small businesses enjoy a tax-exempt tax regime.

1. How to obtain the Micro Business status?

1.1 Who should we apply for micro business status?

To obtain the status of a micro business, a natural person must apply to the tax authority according to the place of residence or tax registration

1.2 What kind of activities can we carry on?

Processing and sale of purchased goods is allowed. for example:

- Knitting clothes by hand;

- Baking of confectionery;

- Production of handicrafts (eg pots, baskets, etc.) made of wood and clay;

- Car service and other activities

1.3 What activities are not covered by the 30,000 GEL joint income limit for individuals with micro business status?

- Production of various wood products;

- Repair of footwear and leather goods;

- Repair of household electronic products;

- Repair of watches and jewelry;

- Production of brooms and brushes, etc.

1.4 What activities are we prohibited from doing?

- Activities that require licensing or permission;

- Implementation of foreign exchange transactions;

- Medical, architectural, legal or notarial, audit activities;

- Gambling business;

- Trade (except when the purchased goods are processed and delivery);

2. How to register Small Business in Georgia?

2.1 Who should we apply for small business status?

In order to be granted the status of a small business, an individual must apply to the tax authority according to the place of tax registration.

2.2 When is a small business registered as a value-added taxpayer?

A small entrepreneur with an annual turnover of more than 100 thousand GEL is obliged to register as a value added tax payer and exits the special tax regime.

An individual entrepreneur with the status of a small business is obliged to deposit the amounts of current payments in the budget by the 15th day of the following month of each quarter.

Who Can Be Granted The Status of Small Business and be taxed under special regime in Georgia?

A natural person may be granted the small business status, which is an entrepreneur natural person (including individual entrepreneur) and is registered as a taxpayer. Small business status may be granted to an entrepreneur natural person, whose gross income received from economic activity during a calendar year does not exceed GEL 500 000. A person with small business status may have hired a workforce (Article 11, Order N999 of the Minister of Finance of Georgia, dated 31st December 2010).

3% Tax applies to those entities who can not prove 60% of their expenses.

How can small business status be assigned?

In order to obtain small business status a person addresses to Revenue Service (Service-center of the Service Department) with a statement or submits statement electronically via an official web-page of the Revenue Service– www.rs.ge . The tax authority will consider the statement and in case of its approval, it will issue a small business certificate in a reasonable time period. The certificate will remain valid for further reporting periods unless the small business status of a natural person is canceled. (Article 12, Order N999 of the Minister of Finance of Georgia, dated 31th December 2010)

Which Kind of Activities are not allowed under This special taxation regime?

- Licensed Activities

- Currency Operations

- Medical, Architecture Related, Law Consultancy, Notary, Audit, Consultation Services.

- Gambling

- Human Resource Supply

- Manufacturing of Excised Products

Tax Obligations under Small Business Special Regimes

- Withholding Tax- An entrepreneur natural person with a small business status shall not be taxed at the source of payment for issued salary charges not to exceed 25 percent of gross income over a calendar year. And for salary amounts exceeding 25 percent of gross income the entrepreneur natural person will be imposed with the liability of the tax agent. An entrepreneur natural person with small business status is bound to calculate and transfer to the budget tax to be withheld at the source of payment for issued salary amounts exceeding 25 percent before 15th January of the year following the reporting year. In this view, the entrepreneur natural person with small business status shall submit a return of tax withheld at the source of payment to a tax authority. (Article 15, Order N999 of the Minister of Finance of Georgia, dated 31th December 2010).

- VAT TAX – Small business status may not be assigned. except the cases when the natural person is authorized and he/she applies to a tax authority with a request to cancel the VAT payer registration. In addition, registration as VAT payer results cancellation of small business status (Article 11, Order N999 of the Minister of Finance of Georgia, dated 31th December, 2010). Small business status will immediately cancelled from the day of registering as VAT payer ad person will not use the benefits set for special tax regimes

Does entrepreneur natural person with small business status have obligation to record expenses?

Small business shall keep a special register for cost keeping where the information on bearing expenses and costs will be entered in chronological order. The above register shall be established per calendar year and a taxpayer shall keep it for at least 6 years period. In case small business exercises a 3 per cent taxation right of taxable income it is bound to verify the expenses associated with this income as per the method prescribed by Tax Code. (Article 16, Order N999 of the Minister of Finance of Georgia, dated 31th December, 2010)