Table of Contents of this Post

ToggleIf you are thinking to start business in Georgia then step number one is to decide which legal form for Business Organisation are you going to chose. It is necessary to be registered as an entrepreneur-legal person to start a business (an entrepreneurial activity). Georgia introduced simple procedures for registration as an entrepreneur-legal person, also referred as Individual Entrepreneur or Solo Proprietorship. and it takes only one day for this. In order to register a business, it is important to choose among various forms of entrepreneur – legal person, which differs from each other by its nature, obligations and responsibilities. Legal forms are defined by the Law of Entrepreneurs of Georgia.

What are the forms of Business Organization in Georgia?

A legal entity is an organized formation established for a certain purpose, having own property, which independently takes responsibility based on its property, assumes rights and obligations, concludes agreements and is entitled to be presented as complainant and defendant in court. Its purpose is to engage in business activities. These are the options that you have to start business in Georgia.

Entrepreneurial activity is considered a legitimate and not-single activity for making profit, in independent and organized way.

The following enterprises have a legal entity status:

- General Partnership

- Limited Partnership

- Limited Liability Company

- Joint Stock Company

- Cooperative

A legal entity is established since the moment of registration in the Entrepreneurial and Non-entrepreneurial (Non-commercial) legal entities Registry.

General Partnership

General Partnership is a company where several persons (partners) conduct entrepreneurial activity jointly, under one common company name, and are jointly and severally liable with all their assets to the creditors as joint debtors.

A company name of the General Partnership should include at least one partner’s name plus “GP”. If the GP unites only Legal Entities, its name should contain one of the Entity’s company name plus “GP”. All partners are entitled to manage the General Partnership (unless otherwise provided by the Charter).

Limited Partnerhsip

Limited partnership is a company where several persons carry out entrepreneurial activity under one common company name, where the liability of one or several partners to creditors of the partnership is limited to payment of a fixed guarantee amount – limited partners (komandits) and the liability of other partners is not limited – general partners (komplementars).

General partners (komplementars) shall be jointly and severally liable to creditors with all their assets. Together with the rules stated in the general provisions of this Law, the rules for the general partnership shall apply in respect of a limited partnership, unless otherwise provided for by this Chapter.

A partner of a limited partnership may be a natural as well as a legal person. Shares in the capital of the company may be apportioned only among the komandits, unless otherwise provided for by the partners’ agreement.

The company name of the Limited Partnership should contain at least the name of one partner plus “LP”. If only legal entities are united in the Limited Partnership, its name should contain one of their company names plus “LP”.

In case of Limited Partnership general partners (komplementars) are eligible to manage it, and in case of legal entity – an assigned physical person. Limited partners (komandits) do not participate in the managing of the partnership; they may not object against actions undertaken by the general partner (komplementar) within ordinary business activity. Limited partners are entitled to vote only in case provided by the Charter of the Partnership.

Limited Liability Company

A company whose liability to creditors is limited to its assets shall be a limited liability company. Such company may be established by a single person. The agreement of the partners of an enterprise on reducing liability shall be void against third parties.

The capital of a limited liability company shall be divided into shares. A share shall be transferable.

Rights and obligations of the partners and initial distribution of shares is defined by the company statute (by partners’ agreement). It may be defined by the statute, that at making decision, partners’ voting right and/or profit/loss distribution between partners is not proportional to their shares.

Directors are entitled to manage Limited Liability Company, unless otherwise provided by the Charter (partners’ agreement).

Joint Stock Company

Joint Stock Company shall be a company whose capital is divided into shares of a certain class and quantity as determined by the Charter of the company. A share shall be an intangible registered security that evidences the obligations of a joint stock company to a partner (shareholder) and the rights of the shareholder in the joint stock company. The Charter of a joint stock company may determine a value below which the values of shares may not be set for the initial issuance of the shares for a given class (par value).

The liability of a joint stock company to its creditors shall be limited to all of its assets. The shareholder of a joint stock company shall not be liable for the obligations of the joint stock company. When founding a joint stock company, the capital can be determined in any amount.

Shares are registered by a joint stock company itself or by the independent registrar in cases provided by law.

A shareholder’s title to a share shall be evidenced by a record in the Share Register of the joint stock company or with a nominee holder’s record. The shareholder shall be given an extract from the Share Register of a joint stock company or an extract for a nominee holder.

Directors are entitled to manage the Joint Stock Company, unless otherwise provided by the Charter (by partners’ agreement).

Cooperative

Cooperative:

A Cooperative shall be a company based on the labor activity of its members or established for developing the business and increasing the income of the members. The objective of a cooperative shall be the satisfaction of interests of the members. A cooperative shall not aim primarily at gaining profit.

Interesting Facts about Limited Company and Individual Entrepreneur

LLC=LTD – in Georgia – Interestingly enough LLC and LTD are referred to the same thing in Georgia. Once you incorporate limited company in Georgia, government tells you that now you have incorporated Limited Liability Company and then abbreviates it as LTD. Which is weird and confusing. But if you face such a circumstances do not get confused, LLC and LTD is the same thing. Some people have started a business in Georgia, and they were confused about their business status, which is sometimes funny.

Sole Proprietorship=Individual Entrepreneur=Entrepreneurial NaturalPerson – just like mentioned above these are the same names of the one form of business organisation. As mentioned in Georgia there is only six legal form that you can chose for your company. If you hear something new which is not listed above then you should assume that one of the form is referred different way, I guess.

LLC vs Sole Propriertor what are the differences?

Do you want to establish a company but are not sure which legal form to choose? then his video is for you . Here I discuss difference between two most prominent forms for company- LLC vs Individual Entrepreneur also referred as Sole proprietor. Though in this video I discuss Georgia specific example it also applied to general understanding of difference between these two legal forms. These are pretty much the same in different countries, with little variations.

If you are not yet, make sure to subscribe to my channel so as you do not miss any important updates regarding doing a business in Georgia. These topics are highly relevant, because I answer most asked questions of my clients.

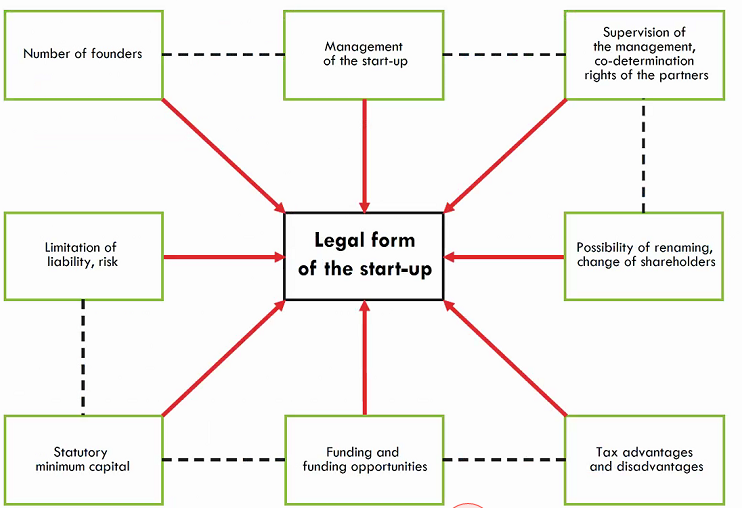

What are the difference between different types of Business Entities?

Before you consider starting your business in Georgia, comprehend below explanation.This picture visualises the difference between different legal forms of Business Organisation. What are the main differentiation between Limited Company or the Sole Entrepreneurship. Or other forms of Organisation. These are main areas of difference. Step number 1 before you start Business in Georgia. Understand Legal Forms of Business Organisation and Taxation.

list of difference points between different legal entities?

- Supervision and Management. Who will be responsible?

- Investorns on Board. 99% cases it must be limited liability company if you want to bring investors on boardlater, you should consider this.

- Tax Advantages – different taxation. Usually Individual Entrepreneurship have way lower taxes than limited companies. It applies to Georgia as well. There is different taxation regimes for Individual Entrepreneurs in Georgia. As soon as you register company in Georgia you can apply for relevant special taxation certificate.

- The risk – Liability. With LLC you are liable with company assets. Whilst, with individual entrepreneurship you are liable with your own assests.

- Flexibility of Board member rotation

What type of Organisation should I chose to start Business in Georgia?

Most Wide-Spread Form of Legal Entity in Georgia is LLC ( often called as LTD in Georgia) People do not usually consider benefits of EP ( Entrepreneur Natural Person ) This is why I am writing this blog today. Let’s compare LLC and NP and than you can decide which legal form to choose to start a bsuiness in Georgia.

Entrepreneur-Natural Person

Limited Liability Company

- Personally responsible with all their assets before creditors for the liabilities arisen as a result of their entrepreneurial activities. Individual. Entrepreneurs act on their own behalf in legal relations, bearing personal

liability for any obligation arising from their entrepreneurial activity.

- Liability of an LLC before its creditors is limited to company assets, and partners are not personally responsible for

company’s liabilities. Accounting, reporting and auditing shall be carried out according to the Law of Georgia on Accounting, Reporting and Auditing.2. A Person of Public Interest (the ‘PPI’), and I and II category enterprises defined under the Law of Georgia on Accounting, Reporting and Auditing shall annually ensure that their own financial statements/consolidated statements be audited in compliance with the Law of Georgia on Accounting, Reporting and Auditi

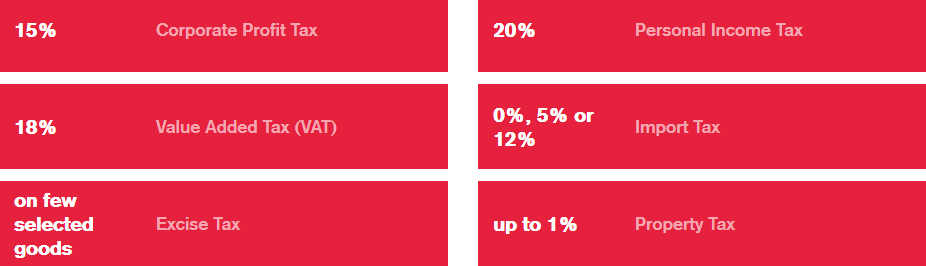

Taxation of Limited Liability Company

There are 6 main taxes in Georgia. You shall not pay all at once. Taxation of your company depends on the nature of your business activities. Each of this taxes, has Its own exeptions that you can claim. More information about Taxation in Georgia to be found by clicking here.

Taxation of Entrepreneur - Natural Person

Only Having this form of Legal Entity you can claim special taxation regime in Georgia. These are Micro and Small Business Status. These Regimes are guarantee for simplified accounting and tax relief. Here you can find main characteristics of these statuses.

Small Business

Micro Business

- gross income received from economic activity during a calendar year does no exceed GEL 500 000

- Income of an entrepreneur natural person is charged with 1 per cent income tax if an entrepreneur natural person with small business status has a document verifying 60 per cent of expenses (except for employee salary charges) associated with the above gross income gain. Otherwise the income of an entrepreneur natural person with small business status is taxed with 3 per cent rate.

- An entrepreneur natural person with the small business status shall not be taxed at the source of payment for issued salary charges not to exceed 25 per cent of gross income over a calendar year. And for salary amounts exceeding 25 per cent of gross income the entrepreneur natural person will be imposed with the liability of tax agent

- Small business status may not be assigned to a natural person in case the latter is registered as a VAT payer

- An entrepreneur natural person with small business status is bound to pay current tax payments to the budget before the 15th day of a month following each quarter

- In case of payment for the provided services a natural person with small business status is not obliged to withhold tax at the source of payment

- Natural person with small business status is obliged to use cash register for cash payments with consumers

- Small business shall keep a special register for cost keeping where the information on bearing expenses and costs will be entered in chronological order. The above register shall be established per calendar year and a taxpayer shall keep it for at least 6 years period.

- More Info Regarding This Status can be found by clicking here.

- Does not use hired work force

- Independently conducts economic activities and his/her total gross annual income does not exceed GEL 30 000 for a calendar year (Order N999 of the Minister of Finance of Georgia, dated 31th December, 2010)

- Activities Except:

> Activities requiring licensing or permits

> Activities the income gained from which may exceed GEL 30 000 within a calendar year

> Carrying out currency exchange operations

> Medical, architectural, lawyer, notary, audit, consultant (including tax consultant) activities

> Gambling business

> Trading (mentioned prohibition does not concern the cases when treatment and delivery of produced or purchased goods is performed by this person). (Annex 2, Resolution N415 of the Government of Georgia dated 29th December, 2010)

- Person with micro business status is obliged to submit simplified annual income tax return prior April 1st of the year following the report year to tax authority

- A person with micro business status is released from an obligation to use cash register

- Persons with micro business status do not pay current tax payments.

- Person with micro business status does not have an obligation to record incomes and expenses

Take a break and Discover my Youtube Channel 🙂 If you like my blogs motivate me by hitting subscribe button, please

A case Study

Jack is a teacher of English Language and He has got some students. He has hired one assistant who is helping him out with practical work and as well as is accounting clerk. His Annual Gross Income is 29000 GEL. He pays net 7200 GEL as a salary to his assistant. He also has got some other expenses – Rent Fee 4800 GEL per year and utilities 800 GEL.

Jack Claimed Status of Micro Business and Registered as ENP - (Entrepreneur Natural Person )

Jack Claimed Status of Small Business and Registered as ENP

Jack is Registered as LLC and he can not claim any type of Special Taxation Regime

Jack was rejected for this application. He can not claim status of Micro Business since he has hired a person. Micro Business Status Holder Shall not have hired any employee.

Jack was eligible for the status of small business. He saved all his bills and confirmation of rent and salary payments, so he could provev 60% of his expenses. This is way at the end of the year he just payed 1% of taxes on his gross income, which was 290 GEL per annum. He did not withheld Personal Income Tax for his assistant either, since the salary payed was less than 25% of his gross income. So, as a result, he has just payed 290 GEL tax and his net profit of the year was 15910 GEL.

Jack was withholding Personal Income Tax for his assistant each month, which increased his expenses with 1800 GEL. ( 20% is the rate of PIT in Georgia. 9000-20% of 9000 = 7200) Similarly, He was also paying PIT for his rent which amounted 1200 GEL. At the year end, Jack decided to distribute his profit and use it for his Personal Requirements. Profit Tax Base for him was His Gross revenue deducted his expenses – 13200 GEL. Upon Distribution he payed 15+5% of Profit and Divident tax which was – 2640 GEL. ( In case he decides not to distribute his profit, he will not be obligated to pay this amount) As a result his net profit amounted – 10560

Sum Up Comparison LLC vs Individual Entrepreneur :

| Individual Entrepreneur | LLC | |

| Company Name | Same as Personal | Possibility to pick any |

| Corporate Bank Account | Yes | Yes |

| Accounting obligation | Yes | Yes |

| Tax Base | Gross Revenue | Net Profit |

| Corporate Income (profit tax rate) | max 5% | 15+5% |

| Claim Profit Tax Free Status | None | on undistributed profit for reinvestment |

Formation Agents and Bookkeeping Clerks

Intended Conclusion: think twice before you register your legal form and establishment for your business in Georgia. In case you are confused and feel that you need a help, always feel free to claim your free consultation 🙂

Once you are ready to start your company our company is always happy to help you with business setup or accounting. We do provide full package accounting which consists of bookkeeping, tax reporting and reporting. We make sure we provide high quality services at reasonable prices.

Frequently Asked Questions:

Can I register Individual Entrepreneurship with Small Business Status without Being a residents of Goergia?

you do not need to be resident of Georgia to start any type of Business Legal Entity in Georgia. For many country citizens they can stay and have business in Georgia for whole year.

How can I claim Georgian Residency with My Entrepreneurial Activities?

Once you have operating Business and the turnover of 50 000 GEL you are eligible to apply for Work Permit in Georgia. Well, there are some other criteria that you need to meet too obviously, that you can check on the link above. But, yes, most important is this criteria.

Do I need to be living in Georgia in order to get my Business Permit?

actually you should not. You do not need to be living in Georgia in order to get your work Permit. What people often do not understand is the difference between tax residency and work residency. For tax residency you need to stay in Georgia half year.