Table of Contents of this Post

This blog teaches you everything that you need to consider before incorporating an online business in a different country. What are the criteria that you need to consider, what available options, and finally discuss all these criteria on the example of Georgia? In the end, it should be easier for you to analyze the global market and the make best decision for you since there is not a unique solution that works for everybody, that’s exactly why you are reading this probably. Here you will find a useful checklist of things to consider before rushing to incorporating an online business.

Major Takeaways from the below blog

If you are looking to incorporate your online business and minimize taxes alongside, this blog is going to be a great help for you. I discuss all the factors that you need to take into consideration before you rush the process. Take your time and read It, I put lots of effort and took my own experience to write it. If you want to cut it short, here are the major takeaways from the blog.

If you are looking to set up a tax-free Digital Business Online all remotely in a legit country feel free to contact us.

- When you research for the host country for your digital business take into account all the possible outcomes in terms of taxation and hidden fees.

- Many countries apply taxes on foreign income sources. Such, in the US or Germany, even if you pay zero tax in the host country, the residents of those countries still need to declare foreign income and pay taxes in their home countries.

- Get residency in the host country and avoid paying double taxes in home and host countries. Once you are a tax resident in the host country as a digital entrepreneur you are not obligated to pay foreign income tax in the home country, country of your origin,

- Do not mix up residency and tax residency. These are two different things.

- Example of Georgia, a benefit for online businesses such as TAX-free status and the possibility to claim tax residency straight away.

Are you looking for tax residency in low taxation country? Then you are one step further to start the online incorporation procedure. Feel free to contact me for further assistance

How to Decide where to Incorporate Online Business

This blog also tells you Everything that Expats in Georgia need to know before Incorporating an Online Business. Did you know that you could Legally avoid Paying taxes without even leaving your country? You could consider starting an IT business remotely, without visiting Georgia. Either incorporating woo-commerce, Shopify, drop-shipping, e-commerce, or any other types of online business remotely. It takes up to one week to establish a company remotely Once you get IT free zone status you do not pay Corporate Profit Tax. No matter how big your income is.

When your business is remote based and you travel all over the globe, why not choose the most favorable country to establish a company in? Selecting a country for your company is not an easy decision. You want to find the best option that will grant you the lowest tax rates and allow you to maximize your income without creating too much additional work and adding unnecessary complexities to your business.

The practice of incorporating a company in a different country isn’t illegal and is actually a wise business move to make when you aren’t restricted to living in and doing business in one country. Now let’s see what are the criteria to consider, where to start an online business?

Step 1: Which Legal Form to pick for my IT Business ?

The number one task and step one in the incorporation procedure are to understand which legal form are you going to chose for your business. There are several types of legal forms. However, if you are just starting we recommend considering below two legal forms. Both of them have it’s pros and cons. You need to read this very simple and small guide in order to figure out what are their pros and cons and then decide which legal form to incorporate. That is the decision that only you can make depending on your personal requirements and goals.

The two most prominent and recommended legal forms are:

Sole proprietorship: Unless you will be working alone or just with a spouse, this type of business structure isn’t ideal for many IT companies. If you intend to keep the business small, however, a sole proprietorship can work. It is easy to set up and maintain, and you may pay fewer taxes than with other business entities.

Limited Liability Corporation (LLC): An LLC can include one or more owners. This type of business structure requires that members decide if they wish to be taxed as a partnership, corporation, or sole proprietorship.

Step 2: Decide where to Incorporate your Online Business.

List of the Best Countries to Incorporate a Remote Based Company for Digital Nomads. Commonly recommended by other nomads are:

- Singapore

- Andorra

- Cyprus

- Malta

- Hong Kong

- Georgia

- Estonia

- The British Virgin Islands,

How do you actually evaluate and pick the best country to incorporate?

Well, there are several criteria that you will need to consider when deciding on the right country to invest in. Whenever you are incorporating abroad, and you are from Countries Like Germany, the US, where they tax you on your foreign income source too, keep in mind that unless you are legitimately setting up an office and establishing residence of your company in the country you are incorporating, it’s very likely that your country of personal residence will have a claim on your company earnings abroad. In another word, in a lot of countries, if you own 100% of a company that operates in a low or no-tax country, but the management of that company happens in your office at home, your home country can claim that you own a Controlled Foreign Corporation.

In case you do not want to leave your country and you are searching for ways to legally minimize taxes without leaving your place of residency then you need to be very to plan your residency as safely as possible. Some people who do not want to leave their home countries but want to incorporate an online business in a tax haven are looking for a host country that does not apply CFC rules and has a territorial taxation system. While this might be a short-term solution, you should bear in mind a long-term consequence. In the end, if the country does not apply the CFC rule, it does not free you out from your obligation to report in your home county neither does it mean that it will never be applied CFC rules in that country. Especially, if you want to have a business in a real country that is striving for global integration.

With that said, let’s review List of criteria to consider before starting an online business in offshore country:

- Does the country have CFC rules?

- Is there a DTA between the country you are doing business in and the country you are incorporating in?

- Is the country politically and economically stable?

- How easily you can get a merchant account to link Payment Gateway to your e-commerce store?

- Taxes, taxes, and taxes.

- Banking for Online Businesses

- Resident Directors or Local Office Requirements

- Limited Administrative Overheads and after formation cost and maintenance fees

- Do you need a work permit?

For a more detailed explanation with a list of countries that have been most recommended by Digital Nomads refer to this blog.

Still Not Sure Where to Start Your Online Business?

The truth is, there’s no best country to incorporate an online business. There’s no one size fits all solution to company registration. It comes down to your personal residence, company residence and your customers. I love learning about tax but will happily pay more of it to make growing and operating my business faster and easier!

Georgia has been considered one of the best countries in the world for doing business. Hence below I analyze how and if Georgia meets the above-listed criteria since I operate in Georgia at the moment. I will try to be as objective as possible. However, as mentioned, in the end, you need to educate yourself about your country’s tax system, host country’s tax system and make decisions on your own. Since there is no universal decision in anything, that’s why you can so far and read this part.

Why Digital Nomads Consider Georgia to incorporate an Online Business?

One of the greatest benefits of setting up an online business in a place like Georgia is that it’s a real country. It’s not just an island nation that makes a living off offshore bank accounts and shell companies. Rather, Georgia has a more diverse economy and actually charges taxes. For instance, I recently helped some people set up a bank account here in the Caucasus region. They said that, once they knew where to go, it was the fastest bank account opening they have ever done. That ease of doing business is true of the banks in a number of countries in Eastern Europe.

One final benefit of the lesser-known jurisdictions is that there are more services available to you. For example, it’s nearly impossible to get a merchant account in Hong Kong these days. Georgia and countries like it are recognized as legitimate jurisdictions, but there are still challenges to running your online company from smaller or lesser-known jurisdictions. Not every country will have the same challenges, so it is important to look at each limitation in regards to the country you are considering, as well as whether or not said limitation will affect your business.

As we are based in Georgia let’s look through these criteria from Georgia’s perspective and find out why does Georgia attracts Digital Nomads. So basically, why Georgia is one of the best country to incorporate your IT Business is as follows:

Does Georgia Apply CFC Rules?

No CFC Rules – this means Georgia will not share business and banking information with 3rd parties. How, on the other hand, Georgia is striving for euro integration. If CFC rules do not apply today it does not mean that They will be never applied. You need to be careful with this. Also, If Georgia does not apply CFC rules it does not make you free from Tax Reporting to your home country. If your country does not apply a territorial taxation system just like Georgia you will probably need to report your taxes outside of your residence country to your home country.

Does Georgia Have double taxation Treaties with Different Countries?

We are talking about international recognition here. Georgia does have double taxation treaties with many countries. This means you won’t be charged twice. Find here if your country is one of the countries Georgia has a double taxation treaty with. Currently there is 56 active double taxation avoidance treaties in Georgia

Does Georgia Charges its residents taxes on their foreign source income?

Once becoming a resident in Georgia you won’t be charged on your income outside of this country. As you may know, countries like Germany, the US, do still charge taxes even though your income stream is 100% generated from abroad. Georgia does have a territorial taxation system hence once you have residency in Georgia you are not obligated to pay tax on your foreign income. Now, there is a difference between residency and tax residency. That’s a whole different story, which we are going to explain later in this blog.

How stable is economy in Georgia?

Well, if you follow, doing business reports by the world bank, Georgia has been listening on 6th place among the 190 countries in terms of easiness of doing business and business environment. I think that answers the question right? Doing Business covers 12 areas of business regulation. Ten of these areas—starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes, trading across borders, enforcing contracts, and resolving insolvency—are included in the ease of doing business score and ease of doing business ranking. Doing Business also measures regulation on employing workers and contracting with the government, which are not included in the ease of doing business score and ranking. By documenting changes in regulation in 12 areas of business activity in 190 economies, Doing Business analyzes regulation that encourages efficiency and supports the freedom to do business.

Source: https://www.doingbusiness.org/en/reports/global-reports/doing-business-2020

Does paypal work in Georgia?

Speaking about Paypal compatibility, In Georgia, you can withdraw money to a Visa card. When some people face PayPal withdrawal in Georgia with a Master card they have successfully withdrawn it by VISA card. To acquire a VISA card is pretty simple in Georgia for foreigners as well.

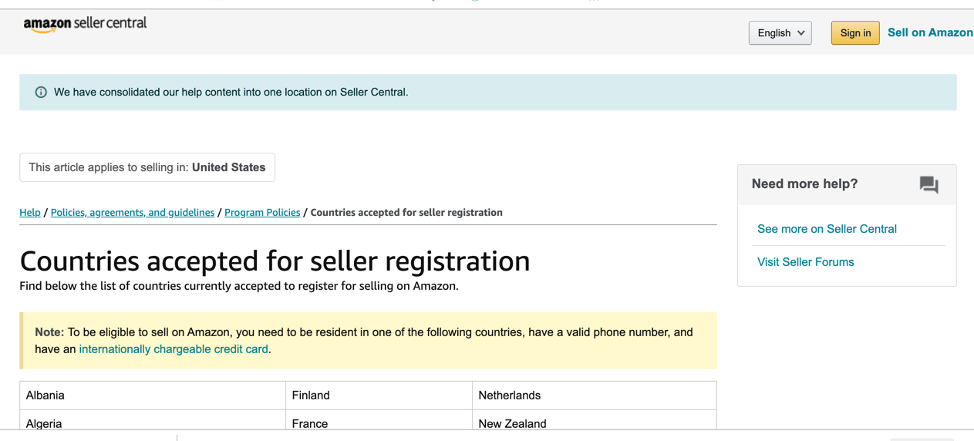

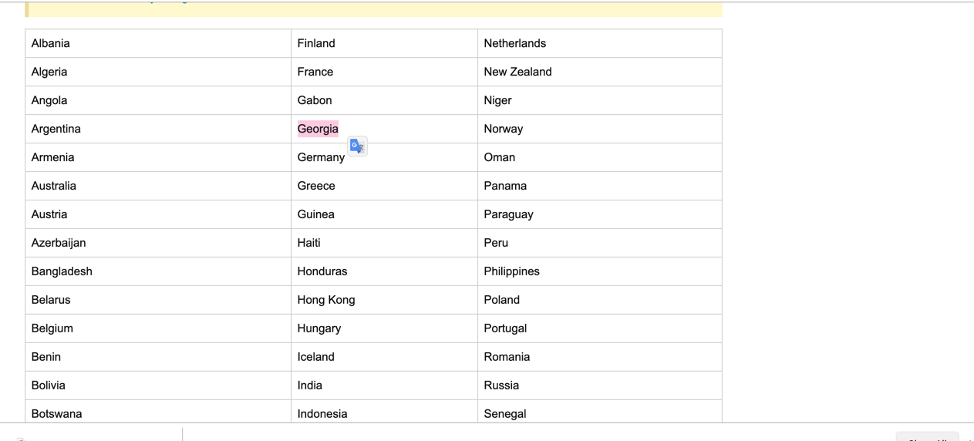

Can I open Amazon FBA Account?

Georgia is an eligible country for Paypal and Fba as well as Shopify business. I personally know some expats who successfully operations Amazon FBA Business from Tbilisi.

Possibility to incorporate tax-free IT Business

Last but not least important topic of the section to consider. Taxation in Georgia. Especially in regards to IT business. Once you open an LLC, which can be also done remotely in 3 days with proper agents you can straightaway apply for the Virtual zone Status. Now, what does virtual zone status do for you? Abracadabra removes the obligation of paying corporate profit tax. In Georgia, there are 6 types of taxes. But as I understand, you are interested to operate Online Business Remotely right? Then you most probably are going to be obligated only for Corporate Income tax which we suddenly removed for you! Basically, you are incorporating in the 6th best country to do business in the World without paying taxes. Now, to be completely fair, you still need to pay 5% of the tax on distributed profit, which is called a dividend tax. There are countries, which, according to superior law, which is Double Taxation Treaties, whose residents do not have to even pay Dividend taxes in Georgia. Not you may wonder about the VAT Tax. Is there a VAT/Value added tax in Georgia? Yes, and It’s 18%. But, if you are selling your services outside of Georgia then you are VAT FREE.

List of Countries who are Completely tax free when doing IT business in Georgia:

- Unites the Arab Emirates

- Estonia

- Qatar

- Malta

- Singapore

- Bahrain

- San Marino

- Cyprus

- Lichtenstein

Hence, if you are a resident of one of these countries why do you even pay taxes? These are the countries that can benefit the most from Georgia’s Virtual Zone status for IT Businesses. You even won’t have to pay 5% of the Dividend tax which other residents do.

Europe’s Best Visas for Digital Nomads 2023

In this blog, we will always keep you updated. If you keep coming back. Here is our 2023 pickup for Europe’s best and most appealing visa programs for digital nomads. In fact, there are regimes created for digital nomads in Europe. In 2023, The most popular is Portuguese, probably also because it’s newer. However, you shall definitely consider other ones that may be competitive with Protuga’s digital nomad visa. In the video below I list today’s best Visa regimes in European countries that will allow you Schengen Visa access as well, and I also tell you some of the most competitive Visa for digital moments in Europe other than Portuguese.

Can you easily link the payment gateway to your e-commerce business?

Both the largest and recommended banks in Georgia TBC and BoG offer you a merchant account. Using their services you can easily link your bank account to your online store and receive payment on your Shopify or dropshipping business.

Is banking system in Georgia Favorable for Online Business?

Is Banking System in Georgia favorable for online Business? It is well know how well developed and ahead of time is Banking in Georgia. Georgian banks offer all modern standards of security and services. It is heavenly simple for a foreigner to open a bank account in Georgia. We recommend the two most prominent banks in Georgia for opening an account for your online business and later linking it to your online store.

How to be completely fair, With the right bank, you could feel comfortable keeping $10 million in Georgia or any of the countries in the surrounding region. Obviously, you won’t feel that comfortable with some banks, so it is important to find the right bank for that amount. That said, if you’re running a 100-million-dollar business, this region may not be for you.

Yet again, if you are running a corporation of that magnitude, you could have some subsidiaries and move that money around. So, can Georgia handle the volume? It depends. But it’s a good question to ask of any country where you are considering registering your company. Ultimately, you have to make the decision. Is paying a little bit of tax worth it for you to get faster services (like faster, more straightforward banking)?

What are after incorproation charges and requirements for my Online Business?

If you do not have activities basically you do not have any obligation. If you do, you need to comply with our taxation and accounting requirements. Find here pricing for this kind of service.

Resident Directors or Local Office Requirements

In Georgia, any country resident can be the director of the company. In case you won’t be able to manage your online business and you will need a management company, also referred to as nominee directors in place, this service is rare but available. You need to understand the legislation of Georgia and bear with the risk associated with having a director in your company.

Do you need a work permit to incorporate an online Business?

Now let’s discuss two scenarios. You are the person who want to relocate in Georgia and the second scenario you do not want to relocate to Georgia but as your country does not apply rules of terriotorial taxation system and you are still axed on your foreign income then you might be looking for easy way for obtaining tax residency without physically being in Georgia.

Option one, obtaining residency when you are in Georgia. Once you have an operating business and your turnover is more than 50 000 Gel you can apply for a work permit shortly saying. If you come from The EU, The USA and many other countries you can have business activities without a work permit for 1 year. Within this one year if you leave the country for a very short period of time and come back then another one year is Georgian borders open for you. There is a difference in tax residency and residency which you need to understand though.

Why you should look for residency in Georgia?

like Germany, the US does tax their residents on their worldwide income. If you are a German citizen you need to pay taxes even if your income has been generated 100% from abroad. Here’s a breakdown of what you should know about your Georgian tax obligations and how living in Georgia will affect your tax obligations if you come from such a country. As mentioned earlier All individuals who are considered tax residents of Germany, the US, and many other countries will pay taxes on their worldwide income whether to Germany or another country. To help avoid double taxation, Germany does have tax treaties with numerous countries that determine where taxes are to be paid. But did you know that there is some legal ways and workaround for this? Stay tuned to learn now.

Hence, you should look for Georgian Residency in order to pay JUST Georgian Taxes and

STOP Paying Taxes on your worldwide income in your country.

What is the difference between tax residenct and residency in Georgia?

We must first understand the difference between tax residency and pure residency .

How, if you have just established a company then a work permit/residency is most suitable for you. We can register you in Georgia without any problems so that you have work residence there. You will then have an Identity Card (ID) and have to come back to Georgia at least once a year so that we can renew your ID. This is a work residence permit. There are some other options for faster gaining residency. This is a residency by Real Estate Investment. Long story short, right after purchasing Real Estate Valued at at least 100000USD you are eligible for this type of residency.

In addition to the residence, there is the tax residence. According to tax legislation, someone becomes taxable as soon as they have stayed in Georgia for more than 183 days a year. Not everyone wants to spend 6 months a year in Georgia. That’s exactly why we can register you as a highly wealthy person so that the 183-day rule does not apply. That makes Georgia even more attractive than Cyprus, for example.

In order for this to work and we can do it with you, you have to meet the following points: Can prove a worldwide minimum income of over 60,000 euros per year for the last 3 years. So in the last 3 years, you must have earned over 180,000 euros!

Those who can classify themselves as HNWI do not have to stay for 183 days at all. If you are interested in one of the above options, please contact us. We offer everything from one source in Georgia.

Georgia has become popular tax haven jurisdiction for entrepreneurs, businessmen, digital nomads, and regional investors due to its business-friendly environment, low corporate taxation, friendly immigration policies, and easy residency options. Georgia offers you an excellent tax system to optimize your personal and business tax burden. Probably the biggest advantage is the tax-free accumulation of profits within your company, as there is downstream taxation in Georgia. If you work in the IT sector, you can operate legally tax-free with an onshore company! Furthermore, Georgia has concluded 56 double taxation agreements! It does not count as an offshore tax haven and has a very good reputation. Invoices from Georgian companies are recognized by the German tax office and can be deducted as costs! In 2020 Georgia will be in 6th place in the global ranking of the World Bank’s.

Step 3: Incorporate your Online – IT, FBA, eCommerce, Dropshipping– business?

How to incorporate your It, Fba, Ecommerce, droppshipping or any other online business?

If you are reading this I assume you are looking for an option to minimize your taxes and at the same time maximize your profit, right? You probably do already have a successful business and search for ways to minimize expenses. Above you have seen how to decide where to incorporate your online business, is it Information technology business, Shopify store, WordPress woo-commerce store, or simple drop-shipping. Now I assume your criteria are:

- To find a faster way to incorporate your online business. How to incorporate your business within days.

- The easiest way to establish your online business. Least bureaucracy. Almost no thresholds or requirements needed. What is the country which offers you the easiest way to incorporate the business? With no minimum capital requirement or whatever requirement it may be.

- Lease expenses in terms of maintaining your company. As Least annual fixed costs as possible.

Now let’s analyse how Georgia corresponds your aims and requirements:

- Open company and bank account in 3 days with proper incorporation agents.

- No minimum capital requirements, no minimum bank deposit requirement, no annual maintenance fee from Government, no liabilities if your company is idle.

- If you do have activities though, you need to have in place a proper accounting team and bookkeepers. What are the prices for the accounting services in Georgia and how to find English speaking accountant in Georgia can be found here?

And last but not least point of this section is that – you can incorporate your business online, without leaving the comfort of your home or chair. You can register your online business remotely, In Georgia. How can we help you to set up your IT or Ecommerce Business remotely?

Here are the steps for Opening an Online Business Remotely in a Tax Haven. To register the company remotely, without a personal visit to Georgia, we can register a company on the basis of the Power of Attorney issued by the client. Power of Attorney should be Notarized and Apostilled (or Legalized). The overall procedure might take up to 1 week.

Steps for Registering a company remotely:

1. We do prepare POA and send to you

2. You need to apostille or Legalize this POA and your passport copy in your country.

3. Send Original Version by Post.

And for the rest, we can take care of. You don’t even need to bother yourself. You may wonder what is the process of establishing a company remotely in Georgia, so check this out.

A proven established low-tax burden for online business

Congratulations, you have made it. As you came so far, you deserve the summed-up video explanation of the topic discussed above. This is how you can stop paying taxes in your country right now and legally start setting up your low-tax online business abroad.

FAQ

How can I stop paying tax on my Foreign Income now?

If you become Georgian Tax Resident you only pay tax on your Georgian Source with Georgian Taxation Regime. There is a difference in Tax Resident and Resident that you need to consider.

How much is corporate Income tax in Georgia, Country ?

Corporation tax of 15%

Does Georgia Apply Control Foreing Company Rules?

So far there is no foreign tax law (CFC rules) in Georgia, so you can legally use foreign companies for tax optimization.

Which business is Tax Exempt?

IT LLC is completely tax-exempt for all IT sales from abroad. Interesting for all software developers, etc. This is a country with no income tax on IT business.

Do I have Accounting obligation after forming an LLC in Georgia ?

Yes. After Incorporating Online Business Actually, that is your only obligation to meet. requirements after establishing a company in Georgia.

Is there VAT/Value added tax in Georgia?

Yes and It’s 18%. But, if you are selling your services outside of Georgia than you are VAT FREE.

VAT exemption?

Yes, if less than 100,000 GEL turnover / year, or for exempt activities such as IT

Does Goergia country have International recognition?

Yes. Also within the EU, through many agreements with Georgia. Invoices are usually accepted without any problems.

Is it easy to open Bank accounts in Georgia?

Easily possible to open , abroad also very easy.

What are Annual administrative costs after starting a business in Georgia?

Very little. Only expenses that you will need to undertake once you setup your Georgian LLC is accounting. You need to have in place a property accountant in order to declare to the government your activities.

Is there any trade agreements between Georgia and European Union?

Yes there is EU-Georgia Association Agreement.

Is Georgia Amazon FBA compatible? Can I incorporate online amazon FBA Business?

Yes. Georgia is Amazon FBA compatible country. Hence, you can freely Incorporate Online FBA Business Remotely and benefit from Georgian taxation.

Is there a minimum capital requirement to start Georgian Company?

You can start Business in Georgia without any such kind of requirement. Minimum capital is not required to establish company in Georiga.Is there a Public register of Businesses in Georgia?

Yes, this means no anonymity. Hit me up, if you prefer staying anonymous.

Can I issue Invoices in euros in Georgia ?

Yes, invoices can be issued in any currency. There is no obligation to settle in Lari.

How long does it take to establish company in Georgia?

Establishment time is Approx. 2 working days, IT license another 10 working days, Remote generally takes longer, as the power of attorney has to be certified by a notary and provided with an apostille.

When am I eligible for residence permit in Georgia?

Once you prove your gross Revenue of 50 000 GEL or monthly income of apr. 1000 GEL. Other way to gain residency is by Investing in Real Estate.

Can I to use a trustee as managing director / shareholder?

Yes, there are nominee services available. You need to be careful with choosing right now. There are some major risks associated.

Consider Sole proprietorship with just 1% income tax!

Tax-exempt free zone companies for Manufacturers!