Table of Contents of this Post

ToggleWhat is controlled foreign corporation (CFC)?

Let’s start with introducing what is a controlled foreign corporation (CFC). This is a corporate entity that is registered and operates in another jurisdiction or country rather than the residence of the controlling owners. The form of control of the foreign company is defined in the region of the U.S. following the percentage of the share possessed by the U.S. residents.

As you find out now, CFC’s laws work in the way of tax treaties to dictate how tax-payers declare their foreign earnings. The advantage of CFC is for such kinds of companies when the expenditure of starting a business, foreign branches, or partnerships with the foreign country is lower even after the tax implications—or when the global exposure could help the growing business.

Step by step - more about CFC

The rules of the Controlled Foreign Corporation (CFC) represent the characteristics of an income tax system designed to artificially defer limited taxes using persons with offshore low-taxation. The rules only apply to the income of a person who is not currently taxed by the subject’s owners. In general, a certain class of taxpayers should include in the income the foreign organizations that control certain amounts of money by them or by persons related to them.

The set of rules generally defines the types of owners and subjects, the types of income or investments that are subject to the exceptions of the current inclusion, and the means of avoiding the double inclusion of the same income. Countries with CFC rules include the United States (since 1962), the United Kingdom, Germany, Sweden, among them Georgia, and many others. The rules may vary considerably from country to country.

mechanism, How does CFC work?

The rules are different, so this item may not accurately describe a particular tax system. However, the listed functions are common in most CFC systems. A person who is a member of a foreign corporation (CFC) controlled by local members must include a person’s share of the CFC’s subjective income in that person’s income. The estimated revenue (often net of defined costs) generally includes the revenue generated by the CFC:

- From investment or passive sources, including

- Interest and dividends from unequal parties,

- For rent from non-contact parties, and

- Royalties from a number of related parties;

- From related parties to the purchase of goods or to the sale of goods where the goods are produced and to use CFC outside the country;

- To provide services to CFCs abroad, to related parties;

- From non-operating, inadmissible or passive businesses, or

It is similar through low-level partnerships and / or corporations.

In addition, many of the CFC’s rules are considered to be the CFC’s estimated dividend, which is borrowed by the CFC from the domestic side. In addition, most CFC rules make it possible to exclude CFC-paid dividends from taxable income on members who had previously been taxed under CFC rules.

CFC rules may have an internal property threshold under which a foreign person is not considered a CFC. Alternatively or in addition, local members of a foreign organization who own a certain portion or less ownership of a class of shares may be excluded from the income regime.

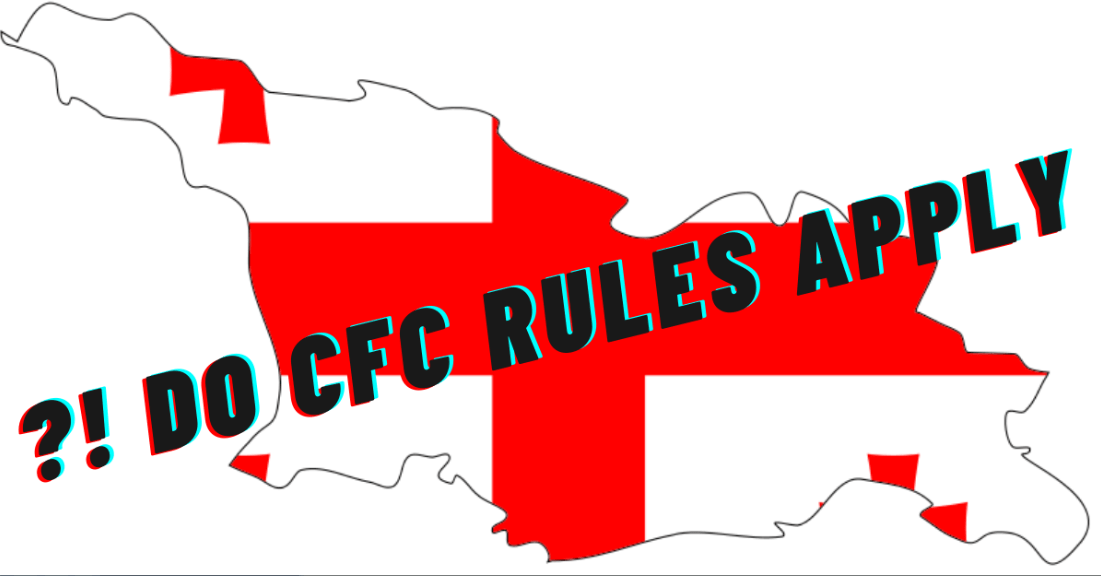

CFC and Georgia, does Georgia applies CFC rules?

Transfer pricing

The rules for transfer fees introduced in the Tax Code are mainly based on the principle of length of the OECD, which is accepted in tax treaties and by most when they follow the rules of pricing of domestic transfers.

The law recognizes five methods of pricing OECD transfer to assess whether prices are at length:

- A relatively uncontrollable price method.

- Selling price method.

- Cost plus method.

- Clear margin method of transaction.

- Profit Division Method.

The Tax Code stipulates that according to the instructions of the Ministry of Finance (Ministry of Defense), the tax authority may recalculate taxes if they can prove that the prices used by the parties to the transaction are different from the market prices.

According to the instructions issued by the Ministry of Finance, the methods of evaluating the rules of transfer pricing are explained and the following procedures are established:

*Determining the comparison of an independent transaction.

*Transaction adjustment procedure.

*The information that the parties send to the tax authority.

*List of documents.

*Source of information on market prices.

*Price range application procedure.

The taxpayer is required to submit documentation to the tax authority to support his income, to be in compliance with market principles within 30 days upon the official request of the Revenue Service. The report can be written in both Georgian and English, but must be translated into Georgian if requested by the Revenue Service. Companies also have the opportunity to sign a pre-pricing agreement (APA), according to which the transfer pricing methodology will agree with the tax authority on specific transactions that will no longer have the right to accrue penalties / taxes on these transactions.

Under the new CIT system, price regulation is subject to immediate taxation.

The following general penalties, which are established by the tax legislation, apply to the principle of arm length in case of non-compliance or preparation or submission of transfer fee documents:

- Impaired tax debt (e.g., VAT, CIT) is subject to a fine of 10 per cent, 25 per cent, or a 50 per cent reduced tax if it is not more than 5% of the total tax amount in the same tax return. Than 5% and less than 20%, or is more than 20% of the total tax amount of the same tax, respectively.

- Late payment of taxes is subject to interest at 0.05% on the due date.

- Submission of the required document is generally subject to a fine of GEL 400.

Finally, take this note that:

- No thin capitalization rules are applicable in Georgia.

Georgia tax legislation does not provide CFC rules.

Georgia has territorial taxation system, what does it mean?

This question turned out the asking object for many investors who wishes to start a business in Georgia. So here we go, I’m gonna explain to you what is generally territorial taxation system in Georgia.

It means that your income from foreign sources isn’t taxed here in Georgia. Maybe you have some businesses abroad but it doesn’t mean it is subject to taxation in Georgia. But the main confusion goes when you start a business in Georgia. I met some people, who misunderstood this regulation by thinking that if you register a company in Georgia and conduct business activities outside you are tax-free. In reality, If you have registered your business in Georgia, this means you must meet the taxation regime here and pay taxes from your income because it isn’t considered as foreign income.