Table of Contents of this Post

ToggleIn this article, I’m going to introduce the free industrial zones in Georgia. I will outline the legislation related to free trade zones existing in Georgia and present all industrial zones operating right now. This article aims to give you a brief yet complete understanding of the free industrial zone in Tbilisi or other cities. We gathered all necessary information on this one page.

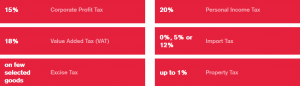

Tax Exemptions in Free Trade zones in Georgia

Taxes and conditions are suitable for every kind of interest. Free trade zones offer real tax relief. Let me will show you what are the benefits and may amaze even! You will be amazed by reducing tax burden.

- Zero profit tax

- Zero Import Tax – foreign goods aren’t taxed in the free zone with additional taxes

- Zero Property Tax – the property in possession is exempt from property tax

- Zero Export Tax

- Zero VAT tax

Allowed activities within free industrial zones in Georgia

Okay, now as we got that there is an exiting taxation in store for free trade zones the logical question might come to your mind. What kind of business can I start in Free Zone? Is there any restrictions on the type of activities that you are allowed to undertake? Can you have service type of business in free zone Georgia? Or just trading? What and where can you trade? These are the questions that may come to your mind right now, I know. Therefore below I will try to address them.

Manufacturing, processing or service of any good is permitted except as prohibited by law. those are:

- manufacture and trade of weapons and ammunition

- nuclear and radioactive substances producing and trading

- submission , manufacture or sale of narcotic and psychotropic drugs

- submission, manufacture or sale of tobacco products

Now, if you are lazy to read this then watch me reading for you 🙂

Reasons for Liquidating Free Trade Zone Company

- Expiry Date – License is Granted for specific date usually by Free Trade Zones.

- Statement of the organizer on liquidation – On your own will company can be liquidated of Course.

- Court decision based on the motion of the Government of Georgia.

Free industrial zones in Georgia

Foti Free Industrial Zone

* started operating in 2010/11/25 during 99 years.

situated on the 304 hectares of town Foti in the place of former port.since 2010 it has been working full time, engaged in various industrial and logistics activities. they are producing light and heavy products such as steel processing.

Kutaisi free industrial zone

Total area consists of 27 hectares . Started operating on 1/07/2009 by organizer and administrator LTD “Georgian International Holding” . Kutaisi FIZ is designed by 100% private capital and founders are Georgian citizens. offers its’s suitable services to investors for company registration in Zone, which you can see below in details.

Tbilisi technological park free industrial zone

Includes 17 hectares.operates for services such as trade , technological service supplior , logistics and other type of companies. the administrator is “Georgian International park” and owner is Dutch company Bitffury BW .operating term consists of 49 years.

Tbilisi Hualing free industrial zone

side of the contract – This zone represents industrial and logistical trade center within the Black Sea area and Kaspian sea countries.territory includes 36 hectares. organizer is “Georgian Huashun Internation Industrial Investment group LTD”. operating term compounds 30 years.

to conclude, I’d like to remind you the advantages of free industrial zones of Georgia ; take a look the following

- tax exemptions

- simplified processions

- payment can be done in any currency

- exempt from the majority of licenses/permits

FIZ Fees

Here comes the topic that you are probably most interested to. What are the fees that apply for all these benefits. What will it cost you to zero your taxes. Here we will try to do our best to make it easy and simple for you the comparison of free trade zone fees in Georgia. Should you need any assistance with application there, feel free to contact us for help.

Hualing Tbilisi Free Trade Zone

Kutaisi Free Zone "GIH"

Top Licenses:

· Production license (USD 2500);

· Special Trade License (USD 3500);

· General trading license (USD 7000);

· Service license (USD 2500).

That’s all you pay for the whole year in order to claim your tax free status. There is special procedure for application in free trade zones, we will gladly help you with all the procedures, so you literally do not need to bother yourself with any of these details

Tbilisi Free Industrial Zone “TFT”

TFZ Enterprises are eligible to develop following businesses:

- IT industry – in particular data and call centers

- General industry (manufacturing and trade)

- Pharmaceutical manufacturing and trade

- Household goods’ manufacturing

- Warehouse and refrigerator facilities

Tbilisi Free Zone offers you following benefits:

- Reliable Infrastructure

- Complete utility services

- Eligibility to national certificate of origin

- Low operational costs

- Low registration and rental prices

- Simplified regulatory procedures

- Direct access to the largest labor pool of Georgia

Companies registered in TFZ are subject to the following fees:

- Registration (fixed, paid only once) – $2.000 USD for foreign individual and $2.500 USD for foreign legal entity.

- License fee (fixed, paid yearly) – from $4.000 USD up to $8.000 USD (depending on business activity).

- Lent fee (negotiable, paid quarterly/twice a year/yearly) – $18.00 USD per 1 m2 per year

Licensing Fees:

* Registration Fee (one time) – 2000 USD

* Annual License Fee – 3000 USD

RENT fees ( monthly)

Land

* Less than 1000 m2 – 2usd per m2

* 1000-5000 m2 – 1.5 usd per m2

* 5000 – 10 000 m2 – 1.2 usd per m2

* 10 000 and more – 1 usd per m2

Building

* Less than 1000 m2 – 3 usd per m2

* 1000-5000 m2 – 2.5 usd per m2

* 5000 – 10 000 m2 – 2.2 usd per m2

* 10 000 and more – 2 usd per m2

Poti Free Industrial zone “PFZ”

A company registered with Poti free zone is exempt from the following taxes:

- Import tax- on any product

- VAT

- profit tax

- Dividend Tax

- one of which is obliged to pay- Income and pension tax

Logistical and Operational Benefits:

· Poti FIZ is located in the vicinity of Poti Port – 2 km.

· Poti FIZ is the only FIZ in Georgia that has direct access to the railway line (the railway lane (146 m) enters the FIZ territory, from which it connects to the international highway)

· Custom check boxes with professional customs officers; Works 24/7

·in TIZ there is a subsidiary company registered which offers investors both brokerage / customs services as well as cargo unloading / unloading services;

you are also able to ask for furthermore information in our contact zone what the advantages of PFZ has.

FAQ on FIZ Georgia

Oh yes, literally, any company should comply with taxation requirements in Georgia. You need to have bookkeeping in place and report it accordingly

- Individual Entrepreneurs (IE)

- Limited Liability Company (llc)

- Limited Partnership (lp)

- Branch Office

- General Partnership (gp)

- Joint Stock Company (jsc)

Declaimer

This Blog is prepared by based on the legislation and public information effective as of the date of its preparation. It is prepared solely for informative purposes and cannot substitute legal advice and/or cannot be used by third parties for similar purposes. Blog contains general information and does not list any and all items related to the reviewed issue in details. This Brochure is limited to the matters directly addressed herein and shall not be deemed applicable to the explanations, clarifications or matters other than expressly contemplated herein.

FAQs on Free Trade Zones in Georgia

Can I open the service based firm in Free Trade Zones?

While in the past you could open a service-based company in free trade zones, it is no longer possible in 2021. as the world trade indicates too, originally trade zones were made to incite the trading, importing and exporting, also manufacturing. Though initially there was a gap in the legislation, many firms benefited from that. In 2021 the gap was fixed, the law indicates that service-based companies should not be operating in the free trade zones.

What are my alternatives if I can not open a company in the free trade zones of Georgia?

Georgia is well known for its liberal taxation and easiness of doing business. Free industrial zones are not the only incentive that you will find here. Consider also incentives for IT companies or opening individual entrepreneurship with small business status.