Table of Contents of this Post

ToggleAre you interested in where to invest in real estate in 2021? Then you are on the right spot since below you will get an answer to your question. You are gonna introduce to whether it is a good idea to invest in real estate in 2021, I will be listing some of the top reasons why to invest in real estate these days and will present Georgia, as one of the options to invest in real estate in 2021.

How To Make Money Investing In Real Estate

You can make money on real estate in two different ways: the fair value of the property over time (which adds to your value) and the cash flow from the rental income. We will break all that in a minute.

Value Appreciation

In addition to the ups and downs of the housing market, many real estate prices have skyrocketed over time. In fact, household prices have skyrocketed for nearly a decade. Hence, when you are investing in the property market, predictions on the market future comes in place. What you need to do is to think forwards, and answer the question – what are the places that have the potential to grow in the nearest future? Instead of well-known areas, where everyone is already looking to and prices are at their peak, I assume, the wiser approach is to find places which are less popular now but are going to attract more in the future. So be the first one in that market, that’s how true value can be found. We need to be one step earlier to the market.

Rental income

Making money through rental is probably the top reason for investors who decide to buy a property. Once you have found employers, owning property and renting is a great way to make a living without much effort.

Without needing money on hand to cover any repairs or maintenance, your part is hands-off. It is very little you can do if you hire an asset manager — but that will reduce your profits. But remember, dealing with employers can be stressful and time-consuming. Do your homework before letting someone rent your place. He wants to make sure that they keep it in good condition. And always have a written agreement.

How do I determine the best real estate markets for investing?

Now you may ask me, okay we understand that we need to buy the best real estate markets of investing, where prices are low now and will be higher in the future, but the question is how? How do I find them?

Well, that is a legit question. I would be surprised if anyone has an exact answer for you. You need to be alert and smart. However, there are some main patterns that you could look for in a property, checklist for the best real estate markets to consider:

- Labor and the economy

- Population Growth

- Rental / Value Estimation

- Security and crime rates

- School Districts

- Public Transportation

- Domestic, Financial, Tax, and Infrastructure Laws.

I actually created list of 65 items to look for to analyse the market and it’s attractiveness for investment and grouped them in 4 major categories. I have also filled data about how Georgia performs with regards of this important criterias. If you are interested, I can send you an excel file.

The country analysis – How to decide where to invest in Property?

Perform the country analysis. It takes some time but it is definitely worth it. At the end, it is about your money. Just being alert to global market trends is the key. Such as the example of the Republic of Georgia. In 2003 the revolution took place and the country chose the western direction. It was easy to predict that such a rapid change would result in price growth. So did it happen? One of my family members purchased a flat and in 3 months prices doubled.

Then it was announced that Georgia would sign the Visa Liberalisation agreement with the EU. Not surprisingly, it was followed even more interest to the country and once again prices rise.

We need to have a look at global country performance, that would give us a really good idea for deciding where to invest in real estate. Global reports, such as doing business report by the world bank, for example, gives us some idea how a country performs. This report alerts lots of Foreign direct investors, nice country becomes popular for investors, real estate prices result to increase too. The 4 major category to look for country analysis are:

- Country Background check – this is basically macroeconomic indicators.

- Regulatory Framework – Like political stability and social factors.

- Market-Specific Indicators and Taxes – business circumstances

Prediction of 2021 Real Estate market

Given that the pandemic has affected various business sectors and not just businesses, real estate has nevertheless remained one of the topical issues. Noteworthy that after a short time at the beginning of the pandemic, the volume of home sales increased. Consequently, the lack of homes in the market and the low mortgage rate have contributed to rising prices. Finally, rising prices have boosted home values, Generating more wealth for homeowners.

Also noteworthy is fact that most experts are predicting another sustainable housing market in 2021. Most of them even draw the conclusion that growing demand buyers who have stopped buying real estate due to the pandemic; From existing owners who need more space for distance learning for parents and children to work from home; They try to find shelter to prevent the effects of the virus in one family.

What housing experts expect in 2021?!

- Realtor.com . Daniel Hale, chief economist at Realtor.com reported that they consider the 2021 real estate market will be way normal rather than we had an extraterrestrial year in 2020. Buyers may ultimately have a better selection of homes to pick up at the end of the year.

- Redfin – expects at the end of this year, the world will turn to the casual life, Mankind will surpass all the bad scenarios of Covid-19, and business start-ups and day-to-day operations will be under protection. Noteworthy saying that a new cluster of buyers and sellers will join the real estate market, hereinafter which will be best-selling year followed after 2006.

- Zillow – predicts that the year-to-year growth in real estate sales will be the highest in almost 40 years as “the financial reality brings more sellers to market to meet high demand and technology permits for faster relativity with interested buyers.”.

Ways to Invest in Real Estate in 2021

As we already talked about whether it is a good idea to invest in Real estate 2021+. And mentioned some of the top reasons, now let’s find out about the ways to invest in real estate in 2021.

- #1 Investment in a bigger real estate Deal.

Let’s start with the fact that one of our preferred options for investing in real estate is to join others in making a bigger deal. Usually, this deal can be both commercial and residential. :

To summarize, if you want and are looking to diversify your investments but do not have enough money to do s., this can be a lucrative way to start. We consider some of the trusted platforms. For example, they are RealtyMogul, Fundrise.

- #2 To purchase a rental property.

To purchase a rental property gives you an extra source to receive income from your property. It is usually profitable to search for countries that have great potential to advance in this field and at the same time can economically be firm. So, my speech drives the main aim that it is usually better to invest in developing economic jurisdictions in real estate rather than in developed regions where the prices on the property are very high and your gainings will be lower.

Buying rental property directly has two disadvantages. First of all, it usually requires a lot of cash – from the initial payment to the required services. You really need to evaluate whether it is worth the return on your investment.The second major downside of real estate is the relationship with landlords/tenants.

- #3 switching the houses. Switching homes can be a little risky, but it is also very beneficial. And, with commodity prices coming back up, this is a good time to start cracking down on households. Switching a house is the sum of purchase of homes under the market value, repairing them, and then selling them for a profit.

- #4 Rent part from your existing house. In order to try to step on the water for the first time you decide to take up new challenges

- #5 Real Estate Investments Trusts | REIT. Real Estate Investment Trust (REIT) is a brilliant opportunity for you to invest without active participation. REIT is a fund set up in a real estate niche to invest in mortgage instruments, bonds, and stocks.

List of Countries Where to Invest Real Estate in 2021

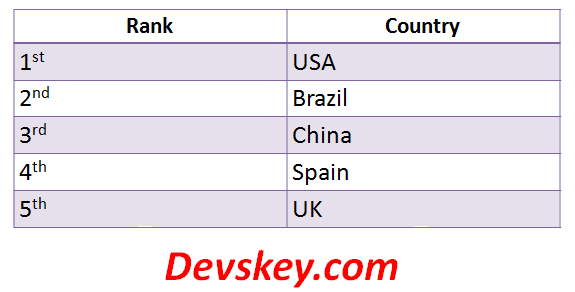

According to the International Investor Survey held in 2018, named the top 5 nations are providing the best possibilities for capital appreciation. Here you can find the countries ranked appropriately. As you can also see the USA has a leading position under this survey.

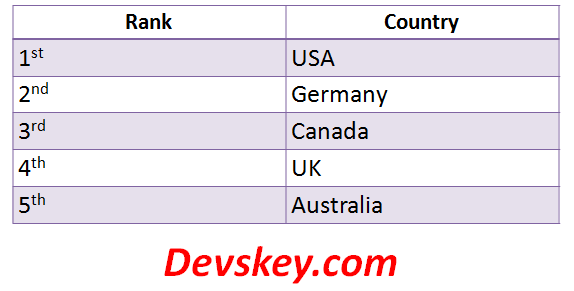

And, in the following chart, you can find the countries ranked according to the most stable and secure ones for real estate investments. It is noteworthy that according to this survey united states remained its leading position and gained 58%

As for the last chart, I would like to share with you top 5 countries considered to be emerging for real estate investment. We hope this comparison and rankings will help you in which country’s real estate to invest in.

Other countries with good real estate investment opportunities

#1 Panama

Starting with, Panama City is one of the best venues and good selections buying real estate abroad. We recommend Panama for two main things. First, flats for rental and agricultural opportunities. Despite, resale transactions in the past years have slowed down, is and will proceed to be a buyer’s market through 2021+.

Nowadays, North Americans and Europeans actively continue to invest in the real estate market, however it’s Panama’s new relation with China that we presume will fuel this economy via its next stage of growth.

And, rental yield 5.75 %, Effective rental income tax is about 2.08% whereas rent – estimated to be $ 2 075.

#2 Portugal

Property (Real Estate) markets in Portugal have been modifying since 2015, making Portugal one of the best alternatives to buy real estate in I should mention that currently rental yield 5.45 %, Effective rental income tax is about 26.45% whereas rent – estimated to be $ 1 939.

#3 France

France is among the top 10 best Jurisdictions to own an investment property, in spite of a low rental yield. Notably, the rental income tax is lower rather than in European countries have, for instance, Spain and Ireland. Alongside, rental yield 2.79%, Effective rental income tax is about 10% whereas rent – estimated to be $ 4 379.

#4 Ireland

It should be noted that high rental rates and yield place Ireland in the top third of most countries, respectively, for owning investment property, but climbing real estate prices requires caution. Hereby, rental yield 6.64% %, Effective rental income tax is about 10.05 % whereas rent – estimated to be $2 077.

#5 Thailand

Put a low effective rental tax rate and relatively high rent together, and Thailand looks like a promising real estate investment opportunity for investors. Definitely to say, rental yield 5.13% %, Effective rental income tax is about 2.73 % whereas rent – estimated to be $2 029.

Georgia another Option to consider for Real Estate Investment

I presented the results of a worldwide held study which revealed the best jurisdictions among good investment opportunities in the world, but here are still some countries left considered to be better than any of them. I mean, it is way cheaper to purchase real estate and get returns much, rather than from the countries listed above.

Emerging Country for Property Investment

I want to introduce you – Georgia, the country, situated on the banks of The Black Sea and crossroads of Asia and Europe in The Caucasus. You have a chance to be one of the first who notices this country. The country is projected to join European Union by 2024, this , people believe that will dramatically increase prices. Right now, you can find decent rental income deals for around 50000USD.

Because of its strategic location, it has a transition function and many of the imported goods are passed through Georgia. Despite this, nowadays demand for Real Estate has significantly grown, conditioned by demand on the market by native residents and as well as high interests of foreigners to purchase a property massively in Georgia. I mean, I want to emphasize the tourism industry in Georgia. Because of the existence of diverse landscapes and resorts (sea and mountain), tourists express interest to rent and buy property in Georgia. Cities Such as Batumi (located on the banks of the Black sea) and Tbilisi (capital, historical city) demanded by tourists. If you purchase property in these areas, for example in Batumi, where we have new, modern construction projects from some of the well-recognized brand developers in the world, you find it advantageous to invest in. As well, here you can find Tbilisi and Batumi – Property purchase Guide in Georgia. In a nutshell, Our Team – Devskey Solutions will try our best to assist investors to grab their best deals in Georgia, feel free to contact us…

Hereby, you can watch the video about Construction projects in Batumi these days …

Real Estate Agents in Georgia, Europe

If you think that you need a real estate agent, who cares more about you rather than commission, than you need to contact us using below form. This way you can buy a house in an emerging, fasters growing economy, with an agent who servers your needs, not just sells.

Afterwards, If you liked our blog and are interested in real estate investment overseas, subscribe to our newsletter, never miss hot deals and receive highly relevant market updates straight to your inbox.

But if anything concerns you, feel free to contact us through the simple contact form below.